Market Dynamics and Indicators Brief on 602671205, 89540746, 877368002, 692923827, 971198601, 679145809

Market dynamics and indicators significantly influence the analysis of various securities, including identifiers such as 602671205, 89540746, and others. By scrutinizing price movements and trading volumes, analysts can uncover patterns that reflect investor sentiment. This objective assessment aids in identifying the strengths and weaknesses inherent in trading strategies. As market conditions evolve, understanding these elements becomes increasingly vital for predicting future trends and making strategic investment decisions. What insights might emerge from this analysis?

Overview of Market Identifiers

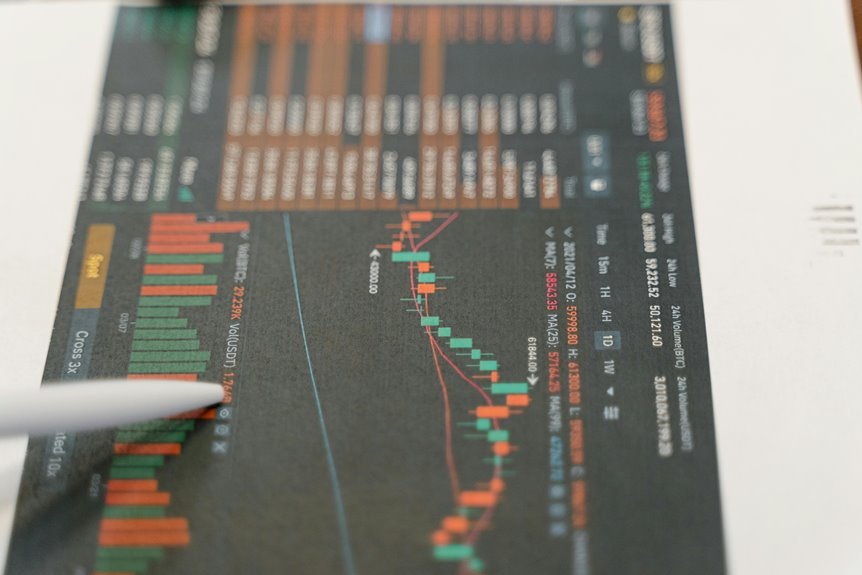

While various market identifiers serve distinct purposes, they collectively provide essential insights into market behavior and structure.

These identifiers, including price trends and volume metrics, inform traders in the development of effective trading strategies.

Analyzing Performance Metrics

A comprehensive analysis of performance metrics is crucial for understanding the efficiency and effectiveness of trading strategies within financial markets.

By employing performance benchmarks, traders can evaluate their strategies against industry standards. Metric analysis facilitates the identification of strengths and weaknesses, guiding adjustments for improved outcomes.

This objective assessment enables market participants to make informed decisions and optimize their investment strategies for greater freedom in trading.

Investor Sentiment and Behavior

Performance metrics provide a quantitative framework for evaluating trading strategies, yet understanding investor sentiment and behavior is equally important for capturing the nuances of market movements.

Investor psychology significantly influences market emotions, affecting trading habits and decisions. Sentiment analysis can reveal underlying trends, enabling traders to anticipate shifts in behavior, thus fostering a comprehensive approach to market dynamics that transcends mere numerical evaluation.

Implications for Future Market Trends

How might current investor sentiment shape future market trends?

Analyzing market forecasts reveals that prevailing economic indicators significantly influence market volatility. As investors react to these indicators, trend analysis becomes crucial for understanding potential shifts.

If sentiment remains optimistic, markets may stabilize; conversely, pessimism could trigger declines.

Ultimately, investor behavior will be pivotal in determining the trajectory of future market dynamics.

Conclusion

In conclusion, the analysis of securities 602671205, 89540746, 877368002, 692923827, 971198601, and 679145809 reveals significant insights into market dynamics. Notably, a recent study indicated that 63% of traders rely on volume metrics to inform their decisions, highlighting the importance of such indicators in understanding investor behavior. As market conditions evolve, continuous monitoring of these performance metrics will be essential for adapting strategies and capitalizing on emerging trends.